The SSM is the governing. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018.

Do I Need To Register For Gst Goods And Services Tax In Malaysia

With GSTN integration you can directly search GST details while creating account and generate EWay bill while creating invoice with just one click.

. The tax applied on the final sale of a product or service in the US is called Sales Tax. GST has been set at zero from 1 June 2018 to be replaced by a Sales Tax on 1 September 2018. A Sendirian Berhad Sdn Bhd company in Malaysia is a private limited business entity which can be started by both locals and foreigners.

It differs from state to state and product to product. You must ensure that IRAS receives your return not later than one month after the end of your prescribed accounting period. Singapore from 1 January 2021 Mexico.

All goods and services are subject to 6 GST beginning midnight on April 1. All businesses in Malaysia are required to be registered with the Companies Commission of Malaysia SSM. Composite supply under GST means if a supply is comprising two or more goods or services that are naturally bundled and sold together.

As of 8 August 2018 the goods and. Mixed supply under GST is when a taxable person combines two or more individual goods or services and sell it for a single price. You can e-file your GST F5 one day after the end of the accounting period.

John subtracts his GST credit from the purchase price 1100 - 100 GST 1000 and uses 1000 to calculate the deduction he is entitled to in his tax return. Taxable and non-taxable sales. Sales tax may be added to the cost of buying goods and services at US retail locations.

Within the passage of 25 years VAT has become the largest source of Government Revenue. The Bersih 20 rally also called the Walk for Democracy was a demonstration in Kuala Lumpur held on 9 July 2011 as a follow-up to the 2007 Bersih rallyThe rally organised by the Coalition for Clean and Fair Elections was supported by Pakatan Rakyat the coalition of the three largest opposition parties in Malaysia but was deemed illegal by the government. John can claim a GST credit of 100 on his activity statement.

These items cannot be sold. Which Countries Charge GST. The government of Malaysia under Mahathir tabled for the first reading Bill to repeal GST in Parliament on 31 July 2018 Dewan Rakyat.

John can also claim an amount that reflects the decline in value of the photocopier on his tax return. In 2012 the Standing Committee started discussions about GST and tabled its report on GST a year later. 1 April The implementation of the Goods and Services Tax GST in Malaysia.

Sales tax on low-value import consignments. 1 Jan 2023. Finalise your 31 July 2018 GST return in Xero.

In 2014 the new Finance Minister at the time Arun Jaitley reintroduced the GST bill in Parliament and passed the bill in Lok Sabha in 2015. After 3 days of working I bought lifetime package plan. When you buy supplies worth 50 or less its still a good idea to get a receipt.

Goods and Services Tax GST in Australia is a value added tax of 10 on most goods and services sales with some exemptions such as for certain food healthcare and housing items and concessions including qualifying long term accommodation which is taxed at an effective rate of 55GST is levied on most transactions in the production process but is in many. GSTR 20131 Goods and services tax. VAT or GST invoices are available for Stripe fees charged under accounts located in.

The states are divided into four zones for rolling out in phases by end of April 2018. Crisis 2 VAT cut on basics is withdrawn. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018.

The pilot started on 1 February 2018 but was withdrawn after glitches in the GST Network. To date roughly 160 countries have adopted a GST or VAT scheme according to data provided by the Malaysian governments Treasury department. Each of these items can be supplied separately.

File the return with IR. A tax holiday was declared on 1 June 2018 and the GST rates were reduced from 6 to 0 which was the beginning of the transition from GST to SST. Increases GST to 8.

Tax invoices sets out the information requirements for a tax invoice in more detail. Sendirian Berhad Sdn Bhd Company in Malaysia Business Owners Must Know. Copy and paste this code into your website.

But if you begin selling internationally it can be helpful to know which countries have GST. You need to keep the tax invoice for your GST records. The Value Added Tax Act 1991 was enacted that year and VAT started its passage from 10 July 1991.

GST will be removed across Malaysia from 1 June 2018 onwards. If GST on creditors is higher than GST on debtors. Now it has been 4 years of using Book Keeper my accounts are always up to date.

Use our easy to use free invoice templates to get started. 1 Jan 2023. We also accept manual payment methods and payment through PayPal for select countries and currencies.

Selling goods or services. Malaysia Goods and Services Tax Singapore Notes. Once you have started to e-file your GST F5 your next GST return will be made available online by the end of each accounting period.

Unlike VAT or GST sales tax is not a flat rate that is applied to your invoices across the board. GST was successfully replaced with Sales Tax and Service Tax starting 1. I started using the demo version.

1 Jan 2023. Lifetime Free for one-off 1500Rs GST. Yet the implementation of the law delayed as it was not passed in Rajya Sabha.

Go ahead and register here. If you want to claim the GST on these purchases you will need a record of the. 6 November The Health Ministry has started a nationwide crackdown by raiding vape stores and confiscating thousands bottles of vape liquid that contain nicotine.

Many people believed that GST increased. GST exemption withdrawn on e-commerce imports. The objective of abolishing the GST was to put more purchasing power in the hands of the Malaysian people especially the lower- to middle-income earners.

Currently you can pay for ads using credit cards or co-branded debit cards. Create your own invoice template. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice.

This doesnt file the return with IR. 1 Jan 2023. In Bangladesh 10 July is observed as National VAT Day.

GST was only introduced in April 2015. Try Easy for free Learn more. If GST on debtors is higher than GST on creditors.

Get all the latest India news ipo bse business news commodity only on Moneycontrol. The unpopular tax was reduced to 0 on 1 June 2018. You should issue tax invoices when you sell goods or services.

Goods and Services Tax GST is an indirect tax or consumption tax. Ensure all other transactions on the GST Audit report and adjustments are correct and complete.

How Is Malaysia Sst Different From Gst

Pdf The Impact Of Goods And Services Tax Gst In Malaysia

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Gst In Malaysia Will It Return After Being Abolished In 2018

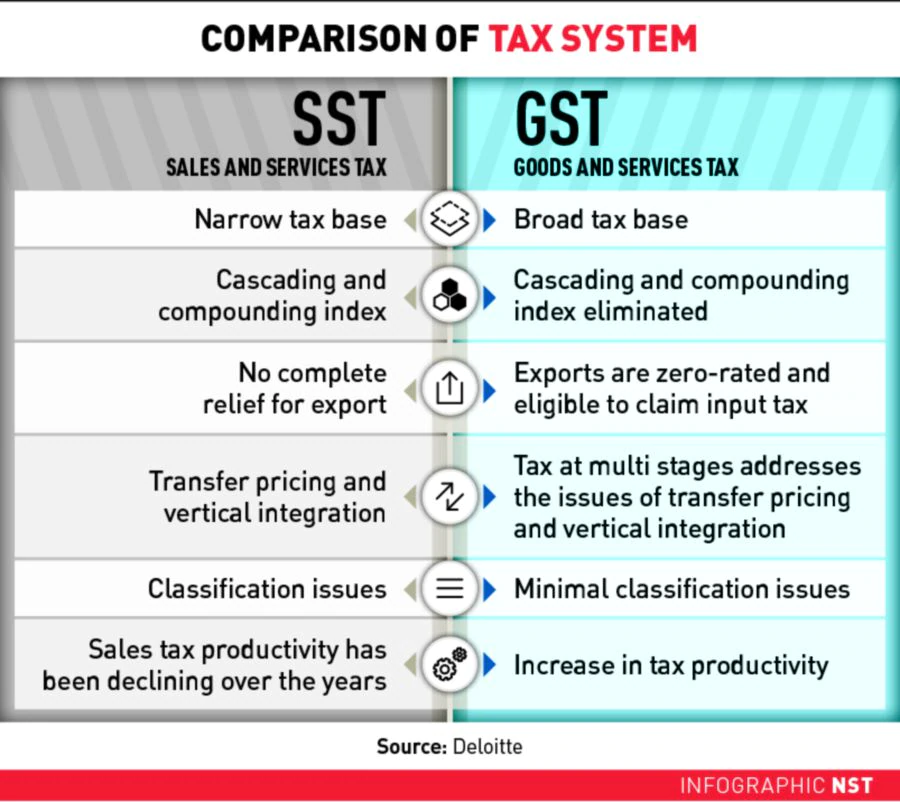

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Brief History About Gst Goods Services Tax Gst Malaysia Nbc Group

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Malaysia May Reintroduce Gst Says Pm Ismail Sabri How Will Car Prices Be Affected Compared To Sst Paultan Org

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

An Introduction To Malaysian Gst Asean Business News

Gst Vs Sst In Malaysia Mypf My

How Is Malaysia Sst Different From Gst

Malaysia May Reintroduce Gst Says Pm Ismail Sabri How Will Car Prices Be Affected Compared To Sst Paultan Org

How To Start Gst Get Your Company Ready With Gst

Gst Rates In Malaysia Explained Wise